“Everyone has a plan until they get punched in the face.”

George Foreman.

With RRSP season upon us, it might be useful to see how the wealthy invest their funds for some indication as to how they differ from average Canadians. As Baron Rothschild famously stated, “The time to buy is when there’s blood in the streets…”, and so do the wealthy, even in difficult times. In other words, they are contrarian investors who do the opposite of what everyone else does, which is a lesson that all investors can profit from.

A place where we can test this approach are energy-focused investments that have been suffering a correction since October 2014. (Note that this is NOT a recommendation about investing in this or any other specific asset class.) The purpose of this article is to test the current conventional thinking about energy-focused investments (oil in particular) to see if Rothschild’s approach may be applicable in this situation at some point in the future.

Investor sentiment (feelings and opinions) towards oil is as close to the worst ever in history and the price per barrel is close to the lows experienced in early 2009 during the Great Recession. Yet many of the fears about oil are overblown according to several investment managers.

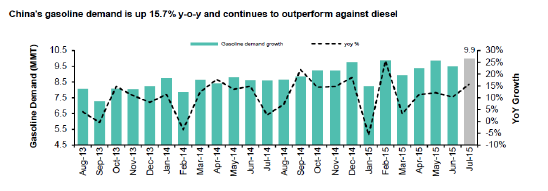

Leon Frazer & Associates notes that over $1 trillion worth of future oil projects have been shelved since November 2014. Conversely, gasoline demand in the US has returned to 2007 levels and is at all-time highs. At the same time, Chinese gasoline demand is up year over year by about 12%.

To top it all off, the US Energy Information Administration forecasts oil consumption to grow by over 1 million barrels per day in 2016, largely closing the 2% gap between global oil production and consumption. While it is unreasonable to expect this imbalance to correct itself in the next few months, it is also unrealistic to expect it will continue forever.

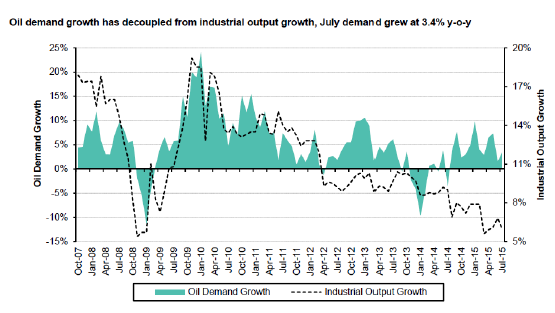

Another myth is that weak oil demand in China`s recently slowing economy is driving oil prices lower. The reality is that Chinese oil demand has been slowing since 2010 so this is not a new factor as this table from Sprott Asset Management shows:

| 2010 | 2011 | 2012 | 2013 | 2014 | |

|---|---|---|---|---|---|

| China Demand (MM Bbl/d) | 9.266 | 9.791 | 10.23 | 10.66 | 11.06 |

| China Growth YOY (%) | 12.8% | 5.7% | 4.5% | 4.2% | 3.7% |

| China Growth YOY (MM Bbl/d) | 1.054 | 0.525 | 0.44 | 0.433 | 0.392 |

| Non-China Non-OECD Demand Growth (MM Bbl/d)* | 1.277 | 1.099 | 0.969 | 0.895 | 0.927 |

Moreover, while the media correctly points to slowing Chinese industrial demand for oil, they are missing the fact that the transition to a consumer led versus export led economy is resulting in double-digit growth in demand for gasoline:

According to Sprott Energy Fund manager Eric Nutall, the supply/demand imbalances are also naturally correcting through lower production levels out of the US, estimated to be lower by 2 million barrels per day by the end of 2015. Drilling activity to find new supplies in both Canada and the US has fallen sharply as well during this correction.

As Nutall states, non-Chinese, non-OCED demand is more important than China (his emphasis) and has been growing on average 930,000 Bbl/d per year for the past 10 years, which he notes no one is talking about!

Lastly, according to Nutall, other than Iran, every major country is in production decline or, in the case of Iraq and Saudi Arabia, production is plateauing. Higher prices are needed to restore profits to the sector as well as encourage capital expenditures through new exploration.

This is the perfect set up for contrarian investors to potentially build wealth in the next couple of years.

Call us today to review your portfolio and to see what types of investment funds are best positioned to take advantage of the new opportunities emerging as a result of recent market volatility.

Do you have questions about your

financial strategies?

Contact our office today !

Copyright © 2016 AdvisorNet Communications Inc., under license from W.F.I. All rights reserved. This article is provided for informational purposes only and is not intended to provide specific financial advice. It is strongly recommended that the reader seek qualified professional advice before making any financial decisions based on anything discussed in this article. This article is not to be copied or republished in any format for any reason without the written permission of AdvisorNet Communications. The publisher does not guarantee the accuracy of the information and is not liable in any way for any error or omission.